Is USAA Good Car Insurance: Military officials created USAA to provide insurance and other financial services to members of the United States military. The company provides affordable auto insurance premiums and is well-known for its great customer service.

How much is USAA car insurance?

Full coverage

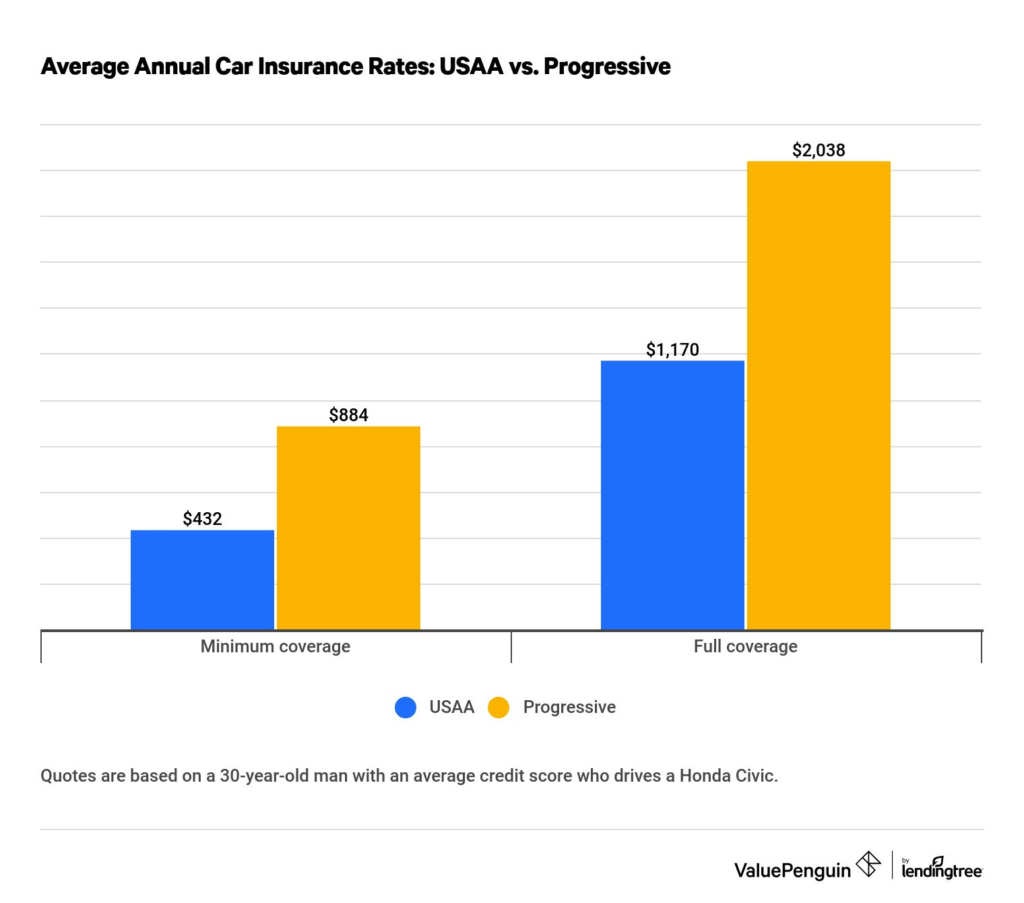

USAA offers the cheapest annual vehicle insurance policy with full coverage at $883, followed by GEICO at $1,047. This policy includes state-mandated liability, comprehensive coverage, and collision coverage, providing financial protection in case of an accident resulting in injuries or property damage.

Minimum coverage

A USAA auto insurance policy with the minimum coverage is $409 per year. Again, this is significantly less than what competitors charge. GEICO has the second cheapest minimum coverage policy in our analysis, at $513 per year.

A minimum-coverage policy provides only the state-mandated liability insurance at the lowest limits permitted by law.

Speeding ticket

A moving infraction, such as a speeding citation, frequently raises the cost of auto insurance. A driver with a speeding ticket pays $1,015 in annual USAA premiums. By far the lowest rate among the insurers in the pool under analysis is this one.

Also Checkout This: How can i get Workers Compensation Ins

Young driver

An 18-year-old’s USAA insurance policy will set you back $2,382 annually. In our analysis, this is the adolescent driver’s auto insurance that costs the least. The USAA premium is actually less than half as expensive as the most. For an 18-year-old, Progressive bills $5,990.

Compared to more experienced drivers, young drivers typically have more collisions. Because of this, insurance for a young driver may be very expensive.

USAA car insurance discounts

USAA offers numerous discounts on auto insurance. While some are specifically designed for individuals connected to the military, many are comparable to those offered by other auto insurance providers. Discounts consist of:

Bundling

When you insure your house and vehicle with USAA, you can save 10%.

Annual Mileage

If you travel less miles annually than the norm, you will pay less.

Storage

If the car is in storage, you can save up to 60%. This reduction is especially appealing to people who want to keep their domestic auto insurance while serving overseas.

Good student

Students that excel academically may be able to reduce their insurance costs.

Military on-base

If the vehicle is garaged on a U.S. military base, you can save up to 15%.

Automatic payments

If payments are deducted automatically from a bank account, you can save up to 3%.

Multi-vehicle

Get a discount when you use the same policy to insure more than one car.

USAA legacy

Offspring of parents having a USAA auto insurance coverage might receive a 10% discount.

Pay as you drive

Similar to numerous other auto insurance companies, USAA provides a usage-based insurance option that bases your insurance cost on actual driving statistics. Car insurance premiums might be lowered for drivers who practice safer driving practices.

Also Checkout This: What Happens if you Crash a Rental Car with Insurance

To whom is USAA auto insurance available?

The only people eligible for USAA insurance services are those with ties to the US military. You must meet one of the following requirements in order to join and be eligible:

- Current members of various military branches.

- Veterans with Honorable or General Under Honorable Conditions discharges.

- Spouses, widows, widowers, and unremarried former spouses of USAA members.

- Children of USAA members.

- Cadets and midshipmen at U.S. service academies or prep schools.

- Individuals in advanced Reserve Officers’ Training Corps (ROTC) or on ROTC scholarships.

- Officer candidates within 24 months of commissioning.

Aside from auto insurance, what other services does USAA provide?

Exclusive to its members, USAA provides a large selection of financial services and insurance products. As per the USAA website, these consist of:

- insurance for homeowners.

- insurance for renters.

- life assurance.

- looking through accounts.

- Cards with credit.

- vehicle loans.

- mortgages on homes.

- savings for retirement.

Bottom line

USAA provides an attractive offer to its intended clientele, which consists of active and retired members of the U.S. military and their immediate families, due to its affordable auto insurance rates, extensive range of supplementary financial products, and excellent customer satisfaction ratings. But not everyone is able to benefit from these advantages.

What is USAA’s phone number?

You can contact USAA by phone at 1-800-531-USAA (8722).

How do I notify USAA about a claim on my auto insurance?

The USAA website allows you to report a claim. You can monitor open claims via the USAA mobile app or online.

How can my USAA auto insurance policy be cancelled?

The USAA auto insurance policy cancellation number is 1-800-531-USAA (8722).

Is gap insurance offered by USAA?

While gap insurance is not provided by USAA, car replacement help is. An extra 20% of the vehicle’s real cash worth will be included in the settlement amount of your total loss claim if you have auto replacement assistance.